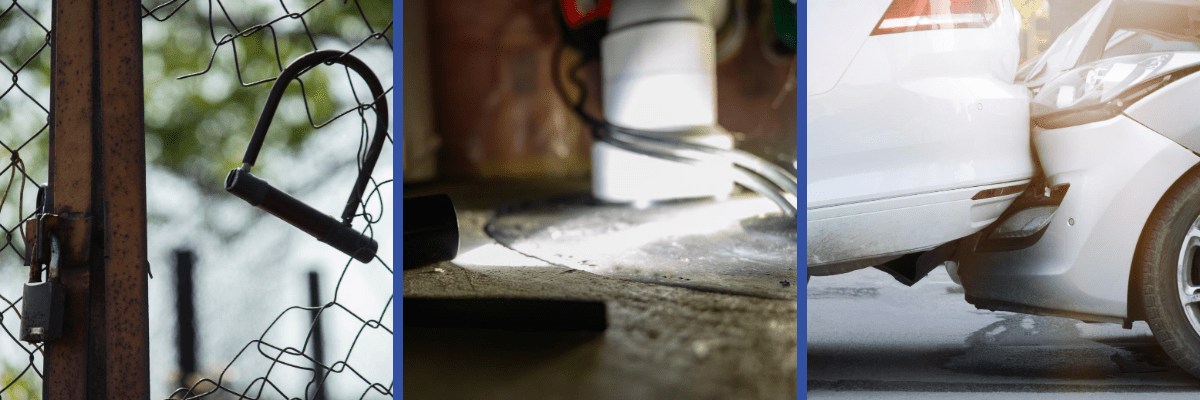

In today’s blog post, we’re covering three big topics we’ve been talking to a lot of customers about lately:

- Theft protection

- Water backup coverage

- Liability-only vs. comprehensive auto coverage

Read on to learn more about each of these topics.

Theft: What Kind of Coverage Do I Need?

Whether you want coverage for your personal items or need to protect your business from theft, insurance can help.

Your homeowner’s/renter’s or business insurance typically includes an endorsement to cover items that are stolen. Always check with your insurance agent to make sure your policy includes this (at Block Insurance,we try hard to make sure all of our policies include theft).

A common scenario for theft is from a building site, when thieves may steal building materials, equipment or other parts left out at a site. Make sure your insurance covers building material theft if this situation could apply to you. Furthermore, if you’re having a house built, typically you as the homeowner need to provide coverage for those materials since you own the property.

There are no set limits for theft coverage, although $10,000 is often the minimum. The amount needed depends on the value of your items or equipment.

What Happens If Something Gets Stolen?

Whether the theft happened at a property you own, or you were on vacation and a theft occurred, your insurance will cover you. Keep in mind, however, that most vehicles – including ATVs and golf carts – need their own coverage in order to be protected.

One exception is stolen cash. Homeowner’s and renter’s insurance policies usually provide minimal amounts of coverage because of the high probability of fraudulent claims. Business insurance coverage does not include stolen cash; a business owner would need to purchase separate crime insurance to have coverage for stolen cash.

When an item is stolen, the first thing to do is contact the police and make a report. Most often, you’ll need to provide a known time – as in, the item was here at 1 p.m. and was missing at 2 p.m. Some insurance companies will ask for proof of ownership, such as owner’s manuals or receipts, but it’s not usually required.

Water Backup Coverage

If you have a basement with a sump pump and/or drain, and the pump or drain fails – for any reason – the only way to get coverage for resulting damage is to have a water backup endorsement on your homeowner’s policy.

$10,000 in coverage used to be the most people could buy, and that was sufficient. But today, if you hire someone to help you remove the water damage and clean – or, say, remove the carpet and damaged contents – you would likely use the majority of the $10,000 and have nothing left to repair the basement.

So, if you have a finished basement, you probably need water backup coverage of at least $25,000 as a good starting point. Companies are now offering more coverage, too, up to $50,000. Call us today to ask about adding more coverage onto your policy.

Note that water backup coverage is separate from flood insurance, which would cover surface water from heavy rains entering the home through a doorway or window. Water backup comes from a sump pump or drain inside the home.

Liability-Only vs. Comprehensive Auto Coverage

You may have heard of people changing their auto coverage on an older car to liability-only. What does that mean, exactly?

“Liability-only is just coverage for the other person in an accident,” said Don Ritchey, president of Block Insurance. “It will take care of the damages of the other person or the damages of the other vehicle and any injuries in the other vehicle, as well as injuries in your own vehicle. But liability only provides no coverage whatsoever on the insurance owner’s vehicle.”

Comprehensive coverage, on the other hand, covers almost any type of peril that happens to your car – like hail damage, a cracked windshield or hitting a deer. There’s also collision coverage in the event you hit another car. Together, they can protect you more fully than liability-only.

However, you can purchase comprehensive auto insurance and remove the collision piece, which tends to be the most expensive.

Talk with your insurance agent to see which option may be best for you.

Have Questions About Insurance?

We know insurance coverage can be complicated, especially if you’re new to it. Our team of experts at Block Insurance can help you understand the coverage you need and find you an option that fits your budget.

Contact us today to get a free insurance assessment and see what you may need.