If you’re renting an apartment or home, renter’s insurance may seem like just another expense on your long list of bills every month. What you may not know, however, is how important this policy can actually be. Read on to learn more about the ins and outs of renter’s insurance.

What is Renter’s Insurance?

Renter’s insurance is like homeowner’s insurance for renters. Basically, if something would happen to your stuff while you’re renting, renter’s insurance would have your back. Renter’s insurance can cover your personal possessions, liability protection and additional living expenses, according to the Insurance Information Institute. Of course, how much it covers depends on your policy.

What Does Renter’s Insurance Cover?

Let’s say you had a few cocktails, did some dancing and stopped for some late-night pizza. Sounds like a fun night out, right? But while you were out on the dance floor, someone stole your brand new iPhone. Bummer. But if you have renter’s insurance, that iPhone would be covered.

What about if your dog bites someone or your friend Courtney falls after a few too many drinks during your house party and gets hurt? Those are situations that could be covered as part of the liability protection on your renter’s insurance.

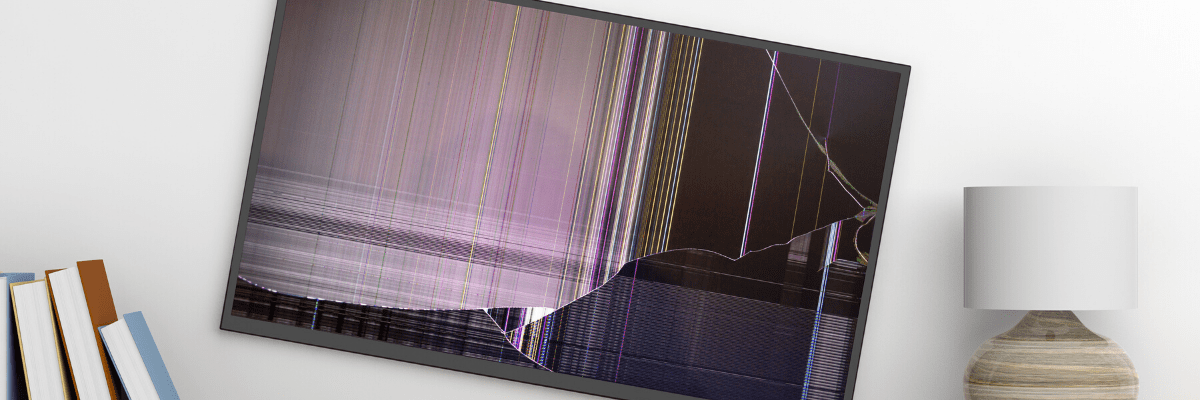

What happens when your upstairs neighbor forgets to turn off his stove and catches your apartment on fire? The building is covered by your landlord, but if you don’t have renter’s insurance, you’ll be responsible for replacing all your belongings out of pocket. However, if you have renter’s insurance, not only would it cover your belongings and any additional living expenses you incur — like living out of a hotel until you can move back into your apartment.

Renter’s insurance can also cover you in the event of certain natural disasters, like lightning or tornadoes. However, if you live in a flood or earthquake-prone area, you will have to check with your insurance agent on what coverage is available to you.

How Does Renter’s Insurance Work? Do I Have Enough?

Renter’s insurance is like your health insurance — you pay an amount every month (called your premium) and then when something happens (like your phone is stolen), you are responsible for paying your deductible before your insurance payment kicks in.

When you set up your renter’s insurance policy, your Declarations page will list a specific dollar amount for your deductible. So if your $700 iPhone is stolen at that club, and you have a $100 deductible, your insurance will cover $600, depending on the policy you choose.

The best way to figure out how much renter’s insurance you need is to inventory what you need covered, and then you can work with an insurance agent to find a policy that works best for you.

Contact an Agent to Find Your Best Fit

Renter’s insurance policies can vary depending on your situation. Maybe you want to pay less per month but have a higher deductible. Maybe you’re weighing choosing between actual cash value and replacement cost coverage.

Learn more about renter’s insurance from Block.